In the last 2 months of 2023, the average, weekly, 30-year mortgage interest rate dropped from 7.79% to 6.61%. With the fall in inflation this past year, the Fed is widely expected to begin dropping its benchmark rate, probably in multiple steps, in 2024. The consensus forecast among analysts is for further declines in mortgage interest rates.

After its end-of-year rally, the S&P Index was up 25% and the Nasdaq up 45% in 2023 (though it has ticked down in early 2024). This plays a major role in Bay Area household wealth.

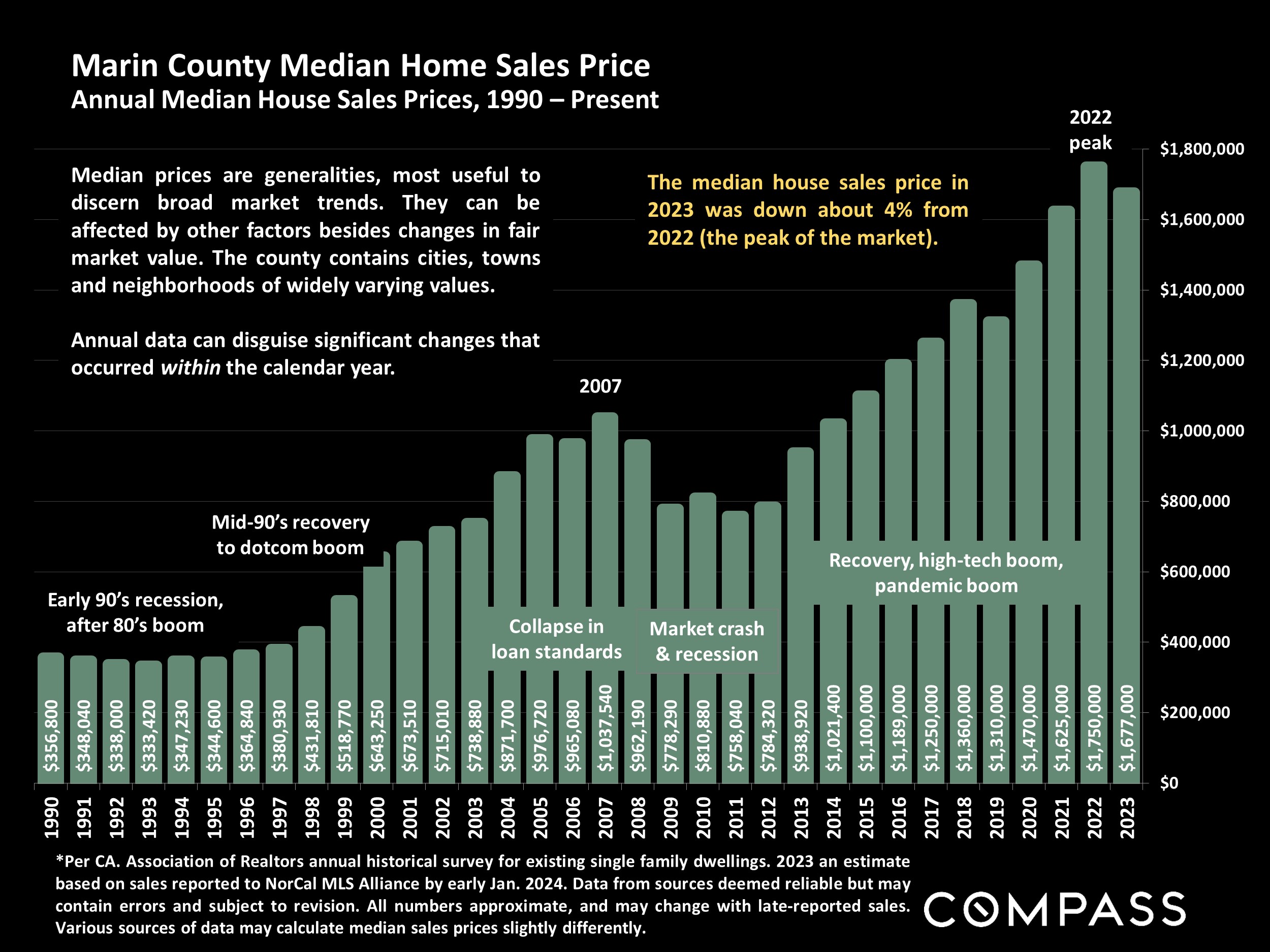

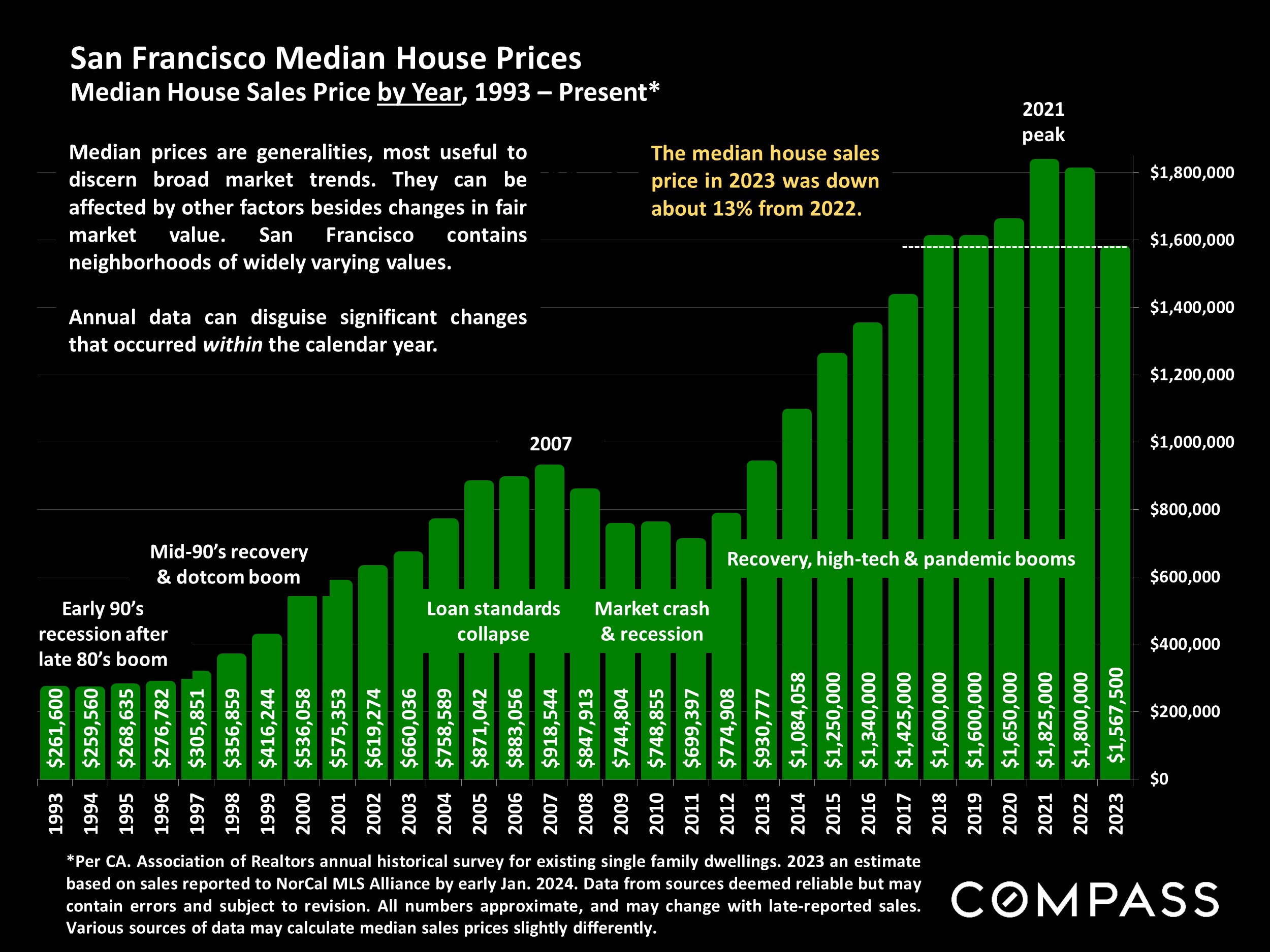

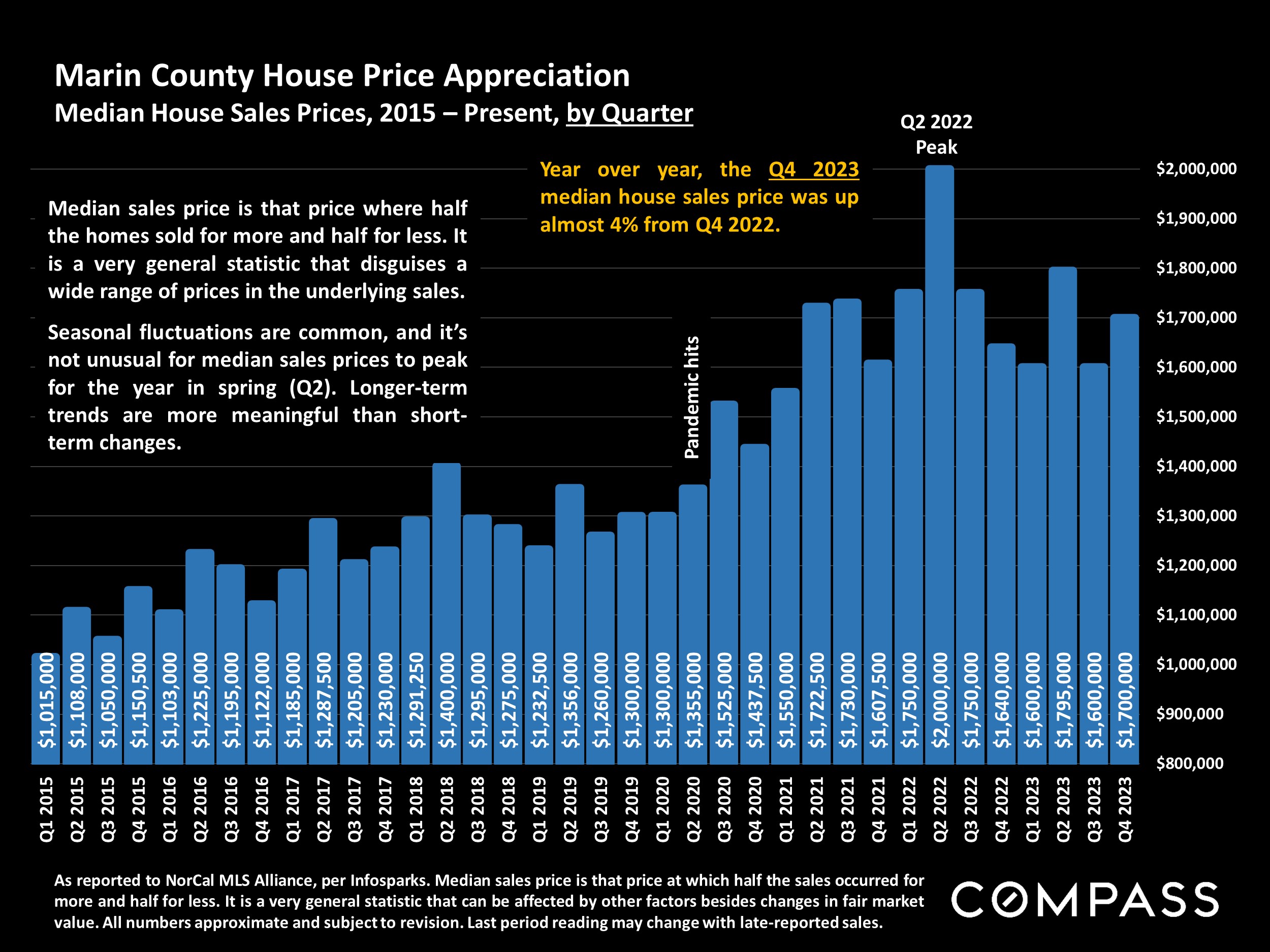

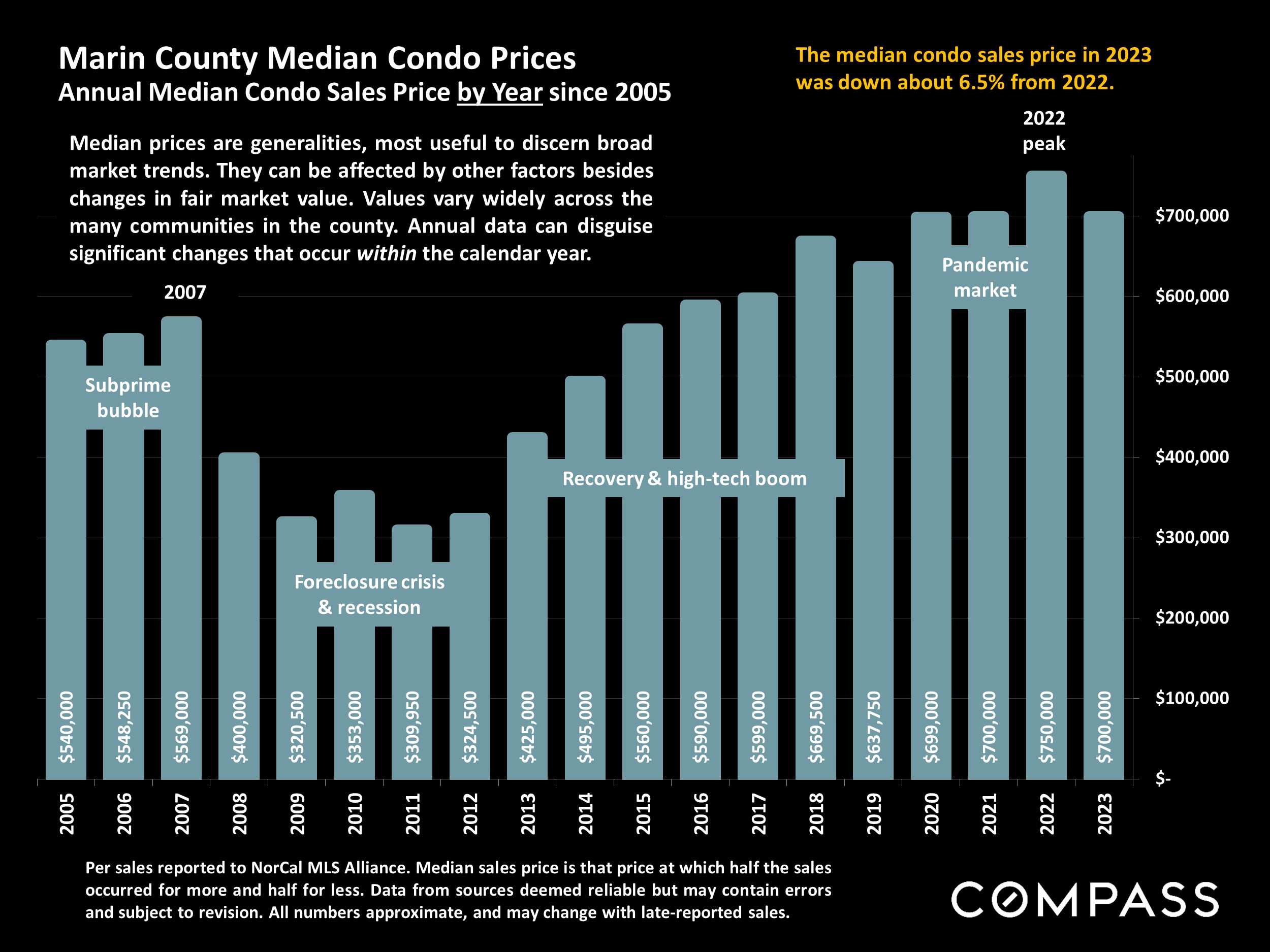

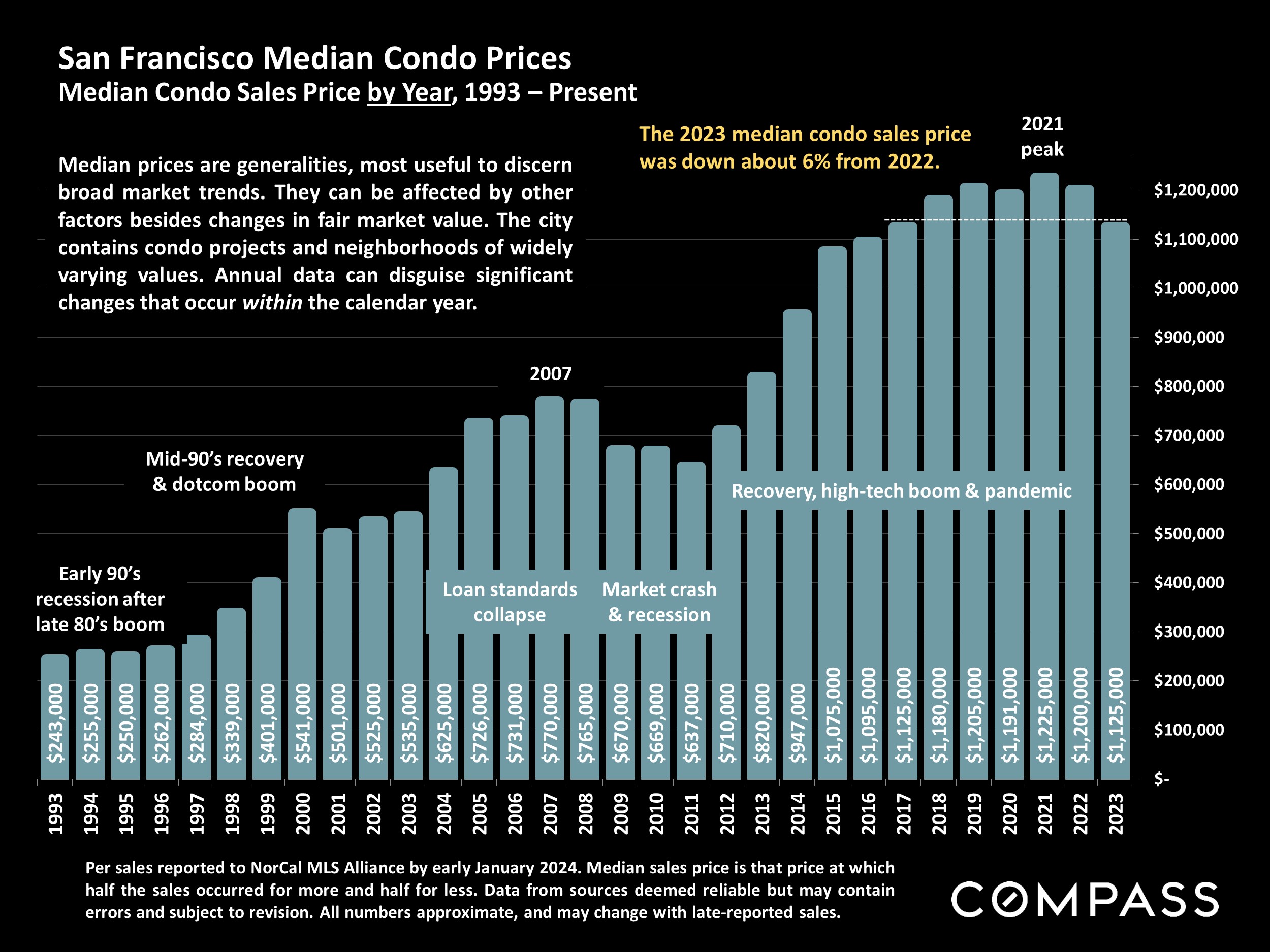

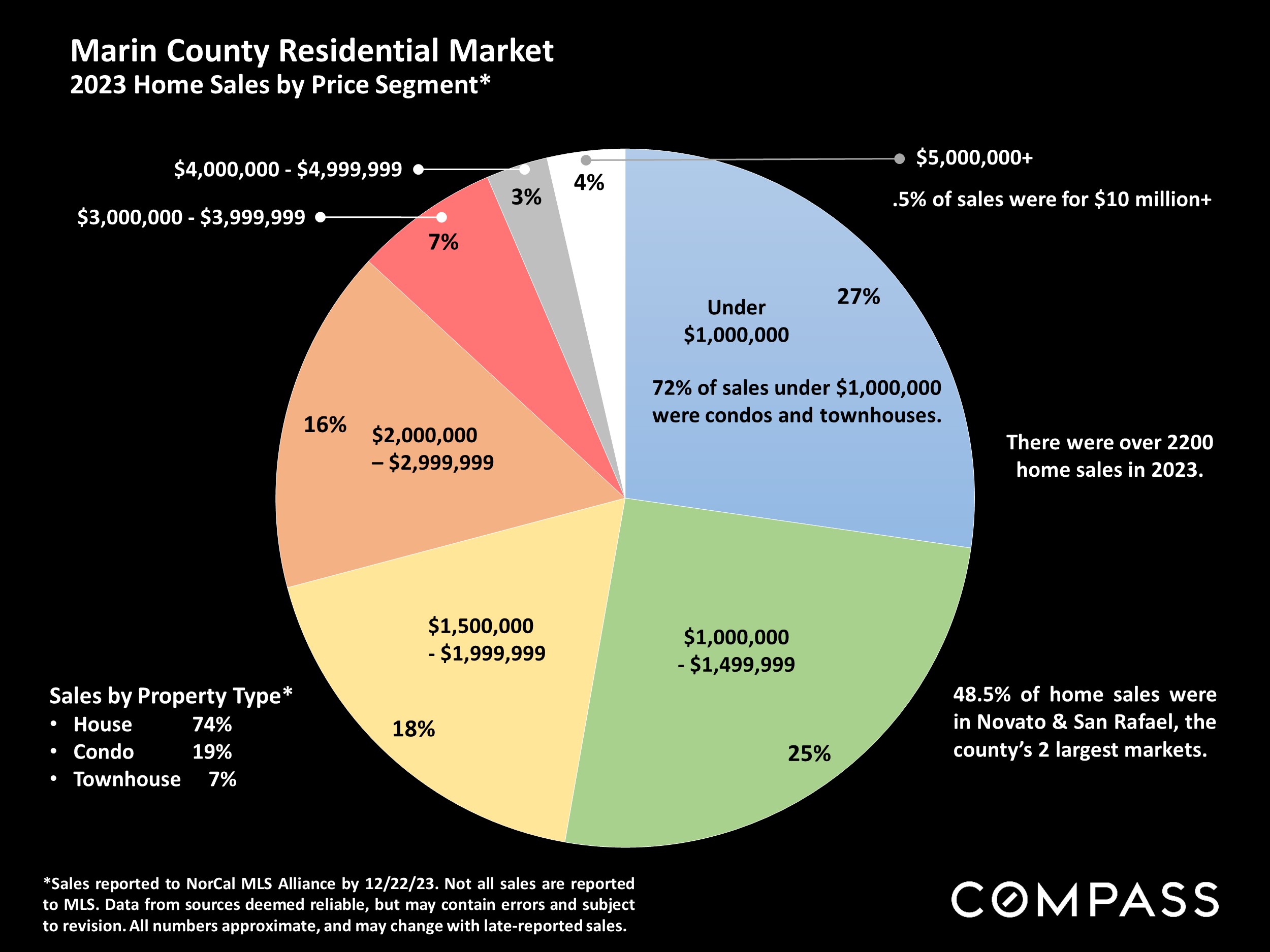

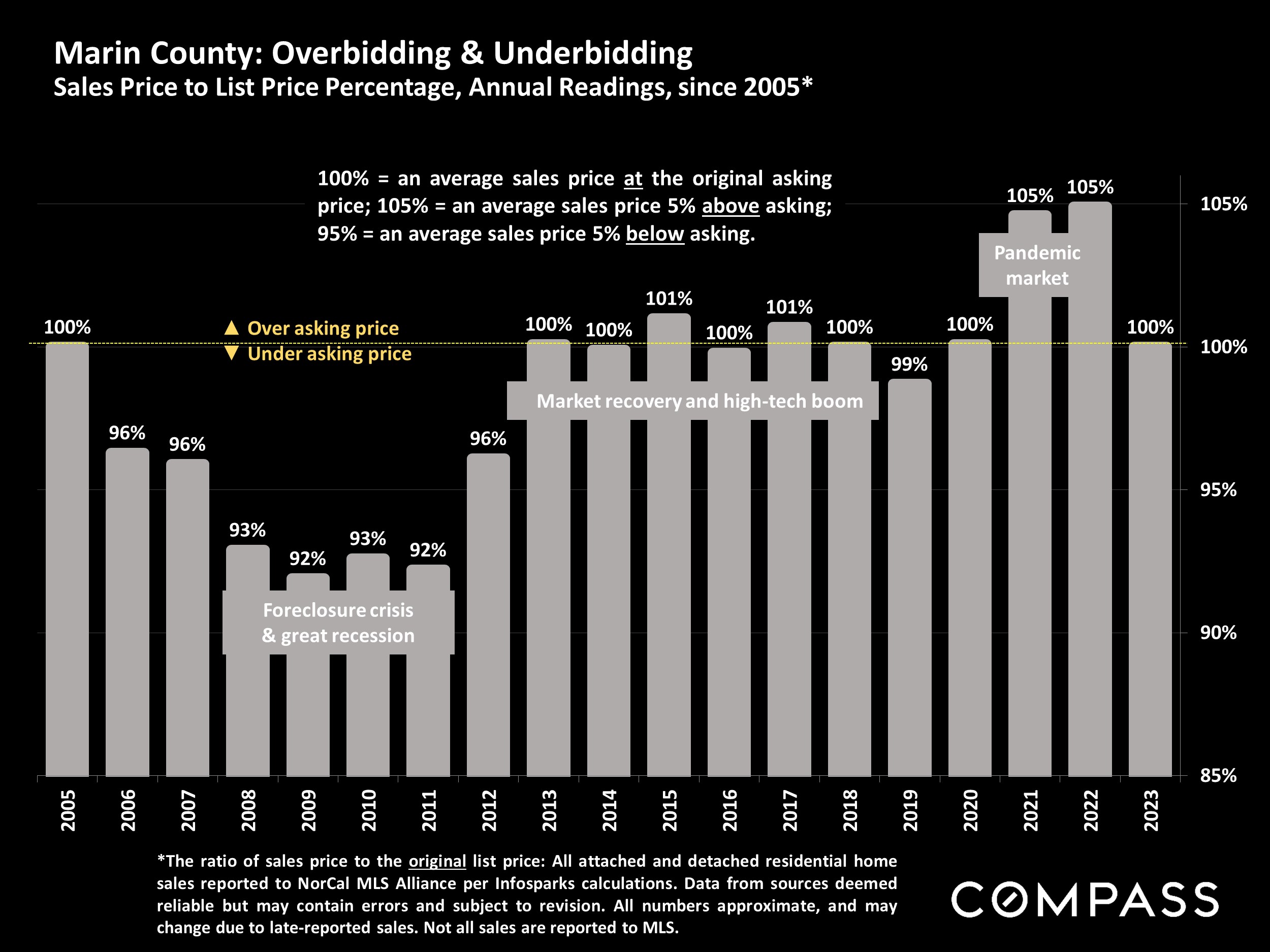

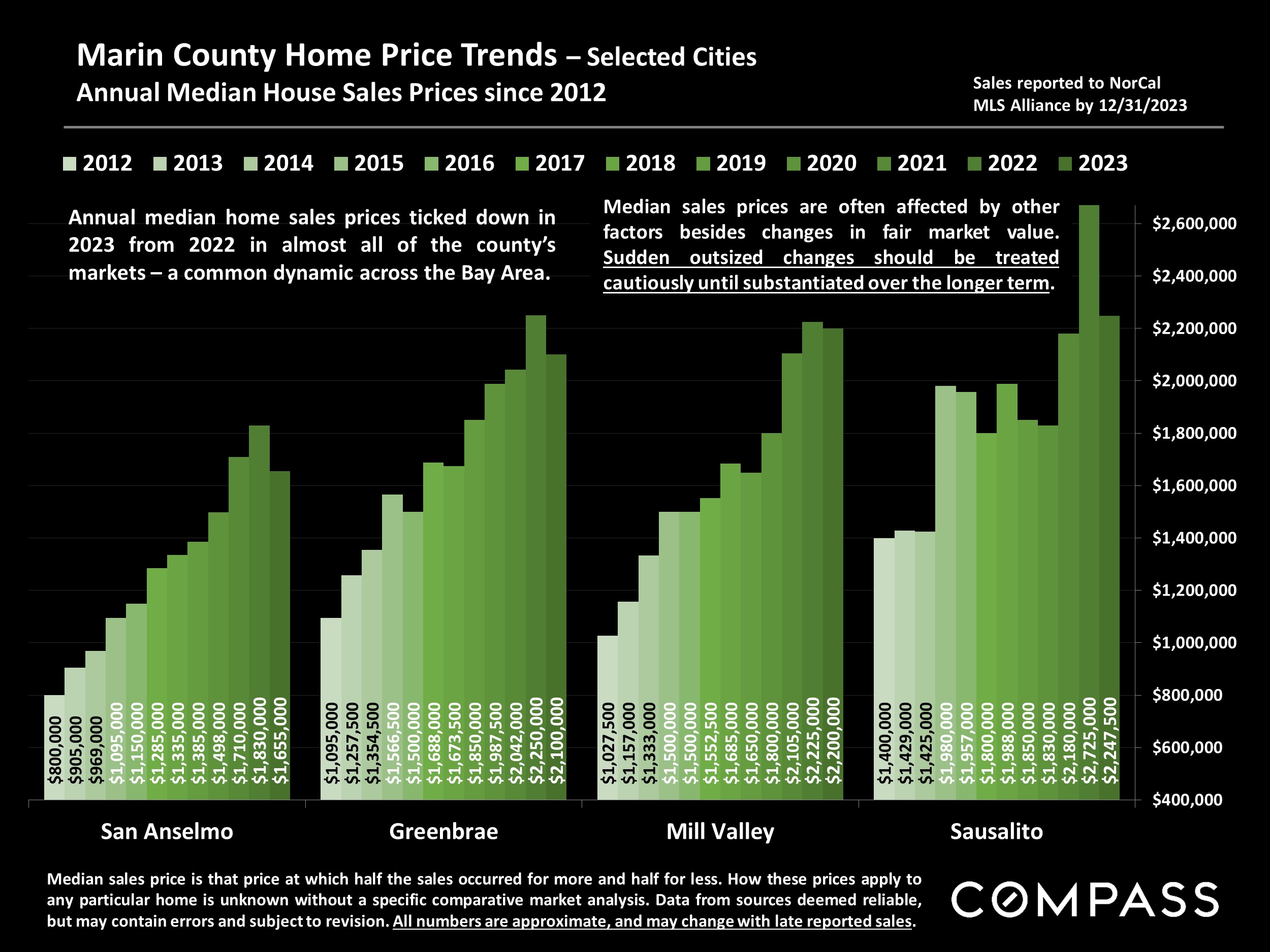

On an annual basis, the 2023 median house sales price was down 4% from 2022 (the peak of the market), while on a quarterly basis, the Q4 price was up 4% year-over-year.

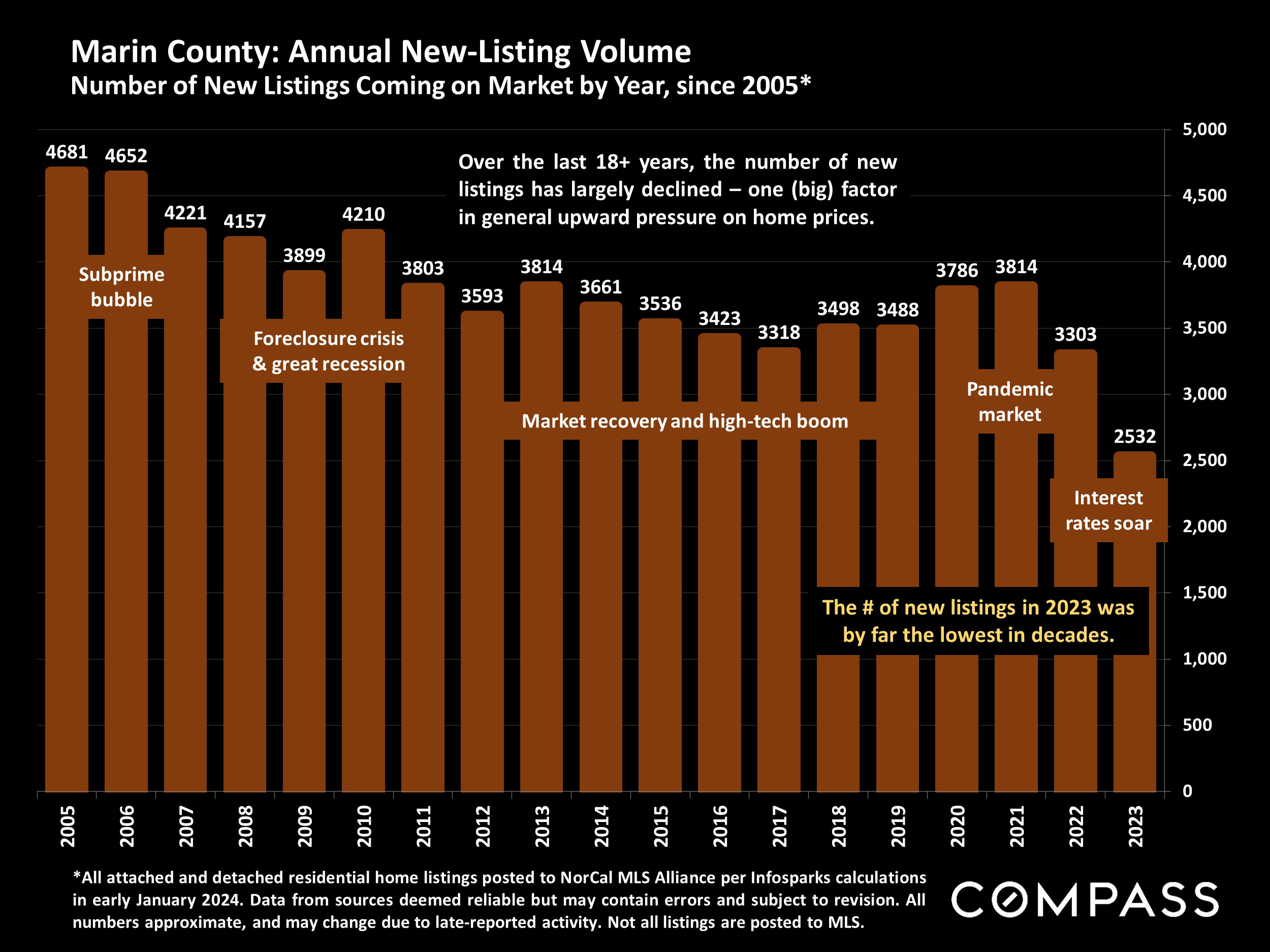

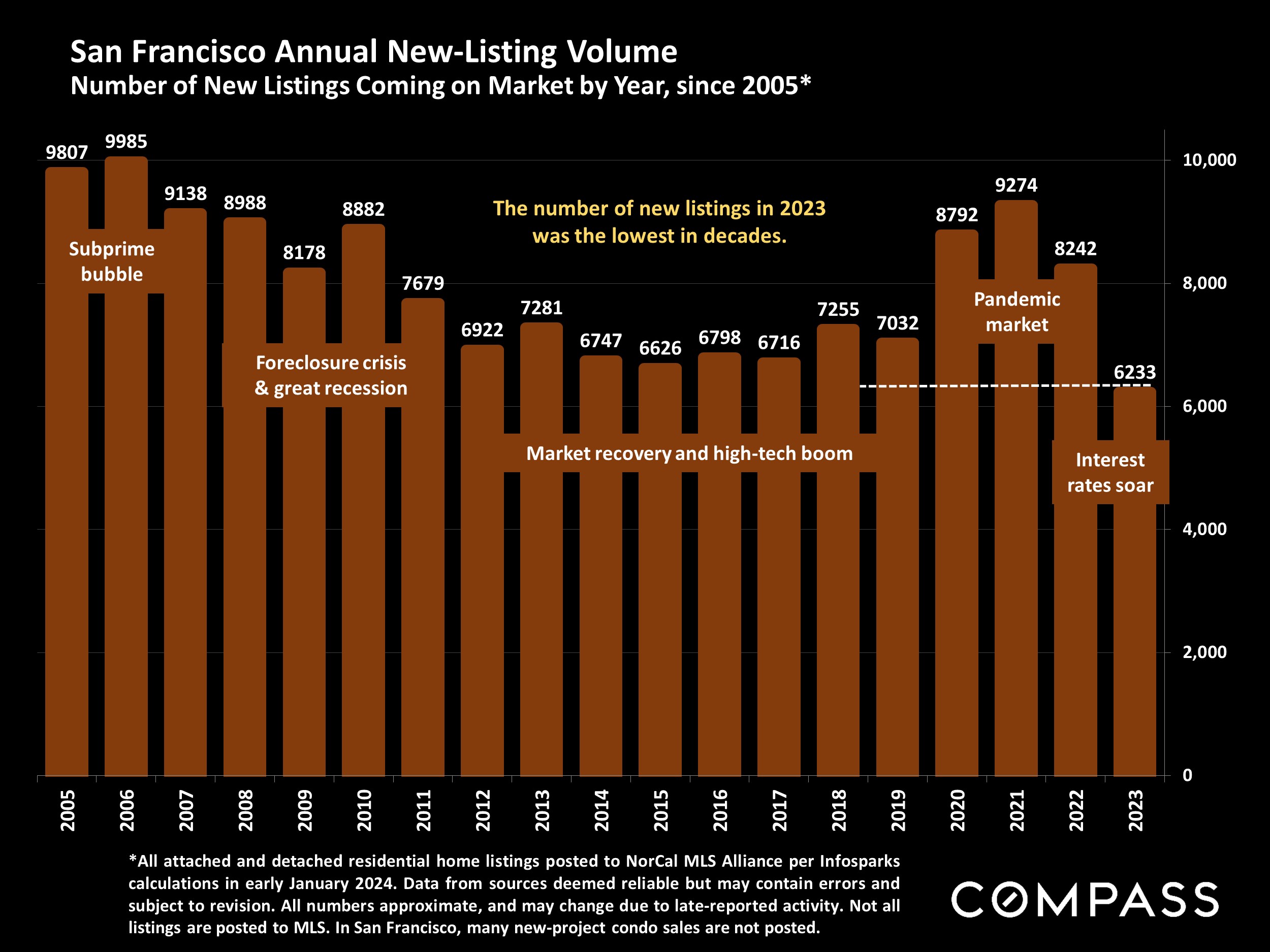

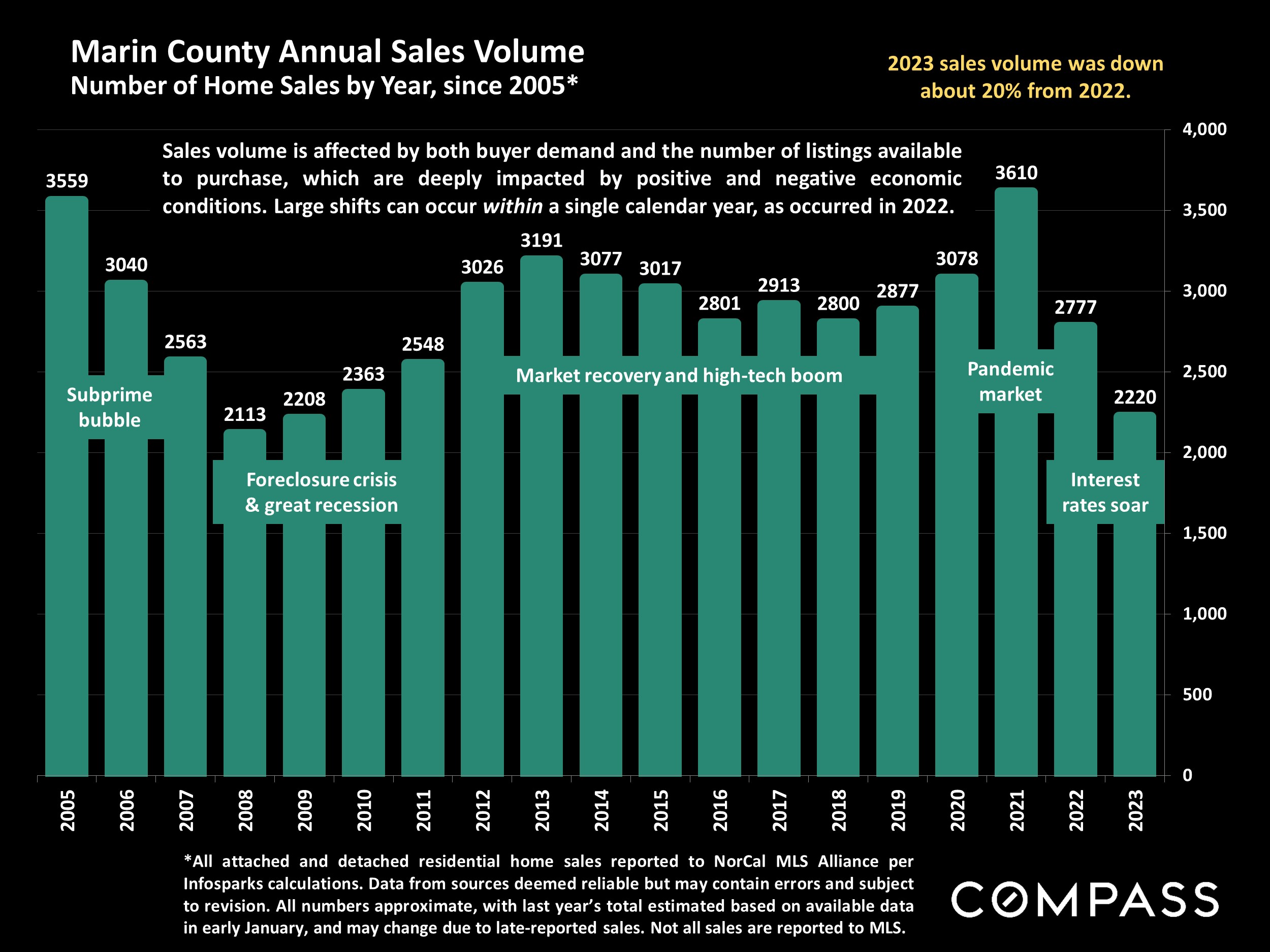

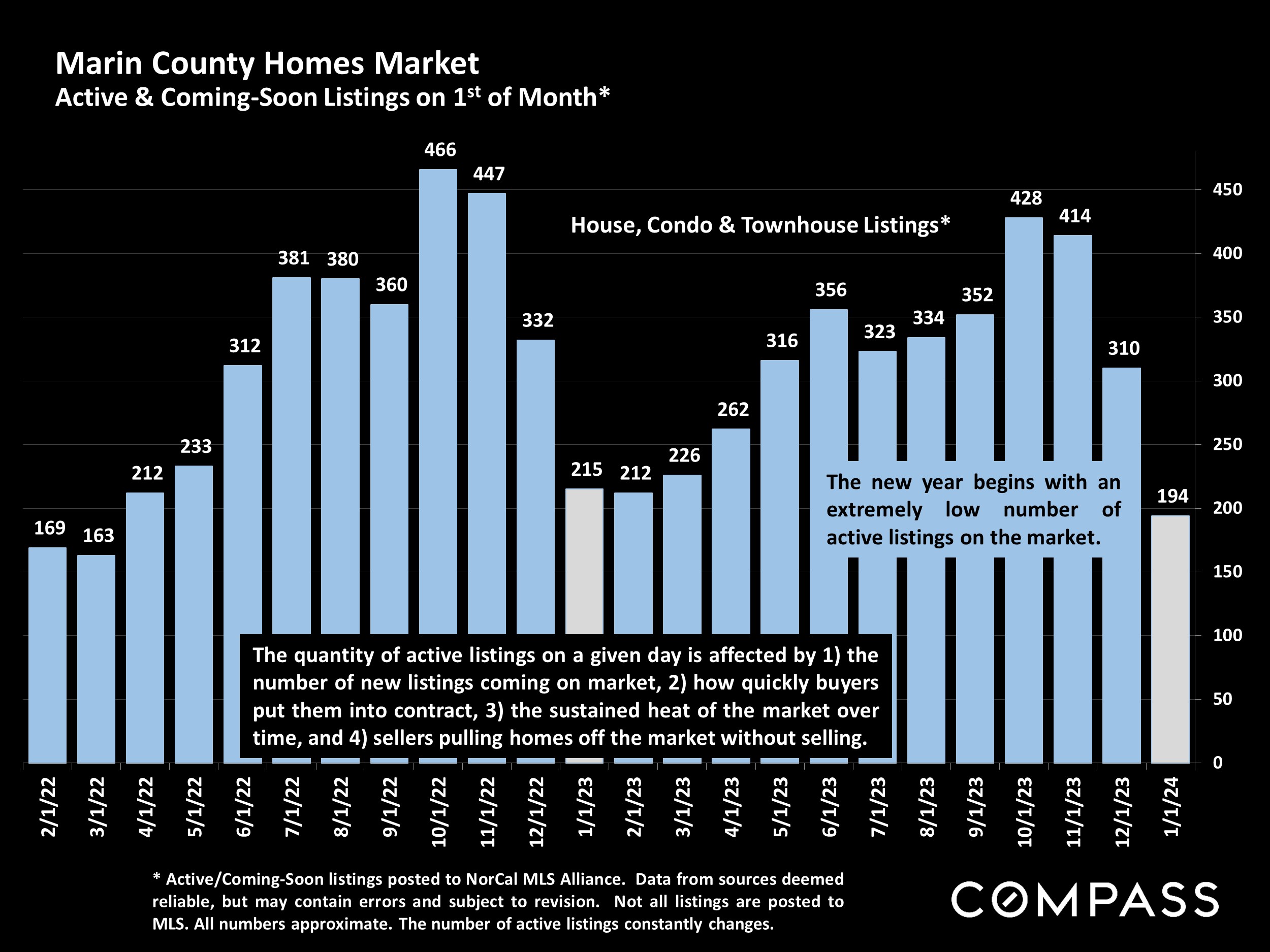

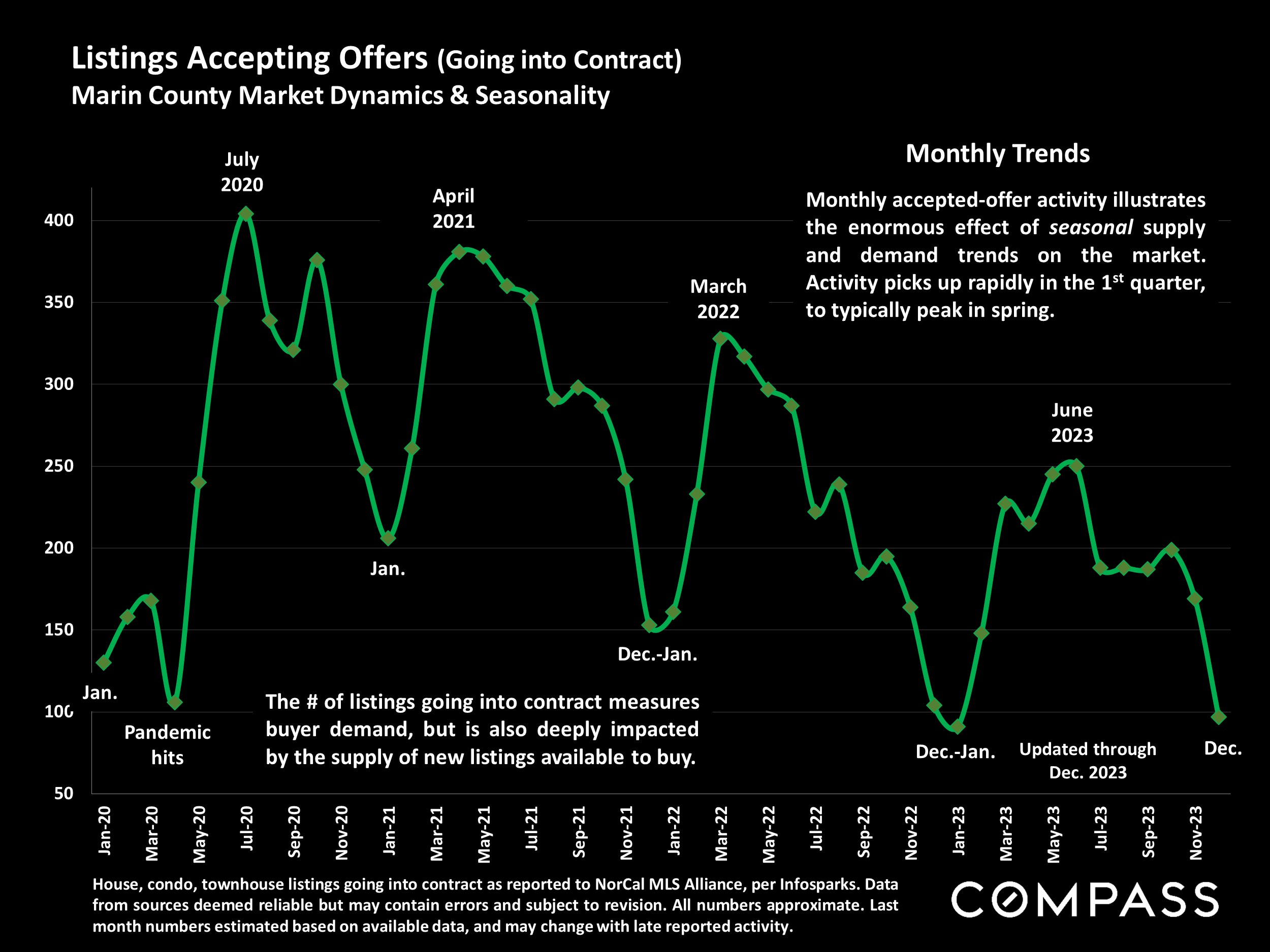

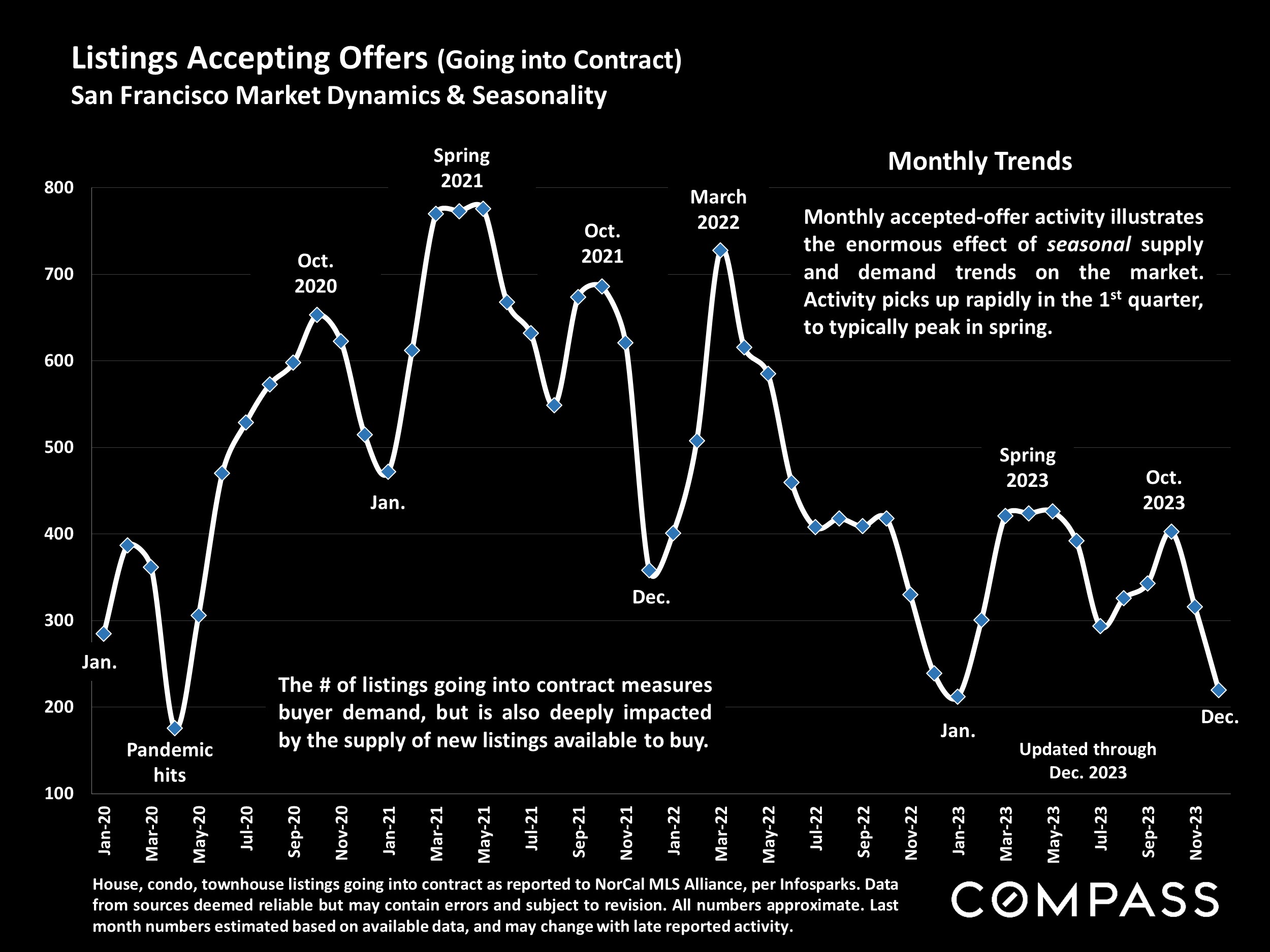

With interest rates falling, and economic conditions and consumer confidence rebounding, the big question is how much do rates need to fall for buyers and sellers to start participating in the market in normal numbers again? Right now, the direction is trending positive.

Reach out to Jonathan Marks if you have any questions, I am here to help you.