If you're considering buying or selling a home, mortgage rates are likely at the top of your mind. According to Keeping Current Matters, mortgage rates directly influence how much you can afford in your monthly mortgage payment, making them a crucial factor in your financial planning. Here's what you need to know about the current mortgage rate trends and how they can affect your real estate decisions.

Current Trends in Mortgage Rates Mortgage rates have been trending downward recently, which is promising news for potential homebuyers. However, it's essential to understand that mortgage rates are influenced by various factors, making them somewhat unpredictable. Economic conditions, the job market, inflation, and Federal Reserve decisions all play significant roles in determining the direction of mortgage rates.

As Odeta Kushi, Deputy Chief Economist at First American, explains:

“The ongoing deceleration in inflation, coupled with the Federal Reserve’s recent indication of potential rate cuts [in 2024], suggests an environment supportive of modest declines in mortgage rates. Barring any unforeseen circumstances and resurgence in inflation, lower mortgage rates could be on the horizon, but the journey towards them might be slow and bumpy.”

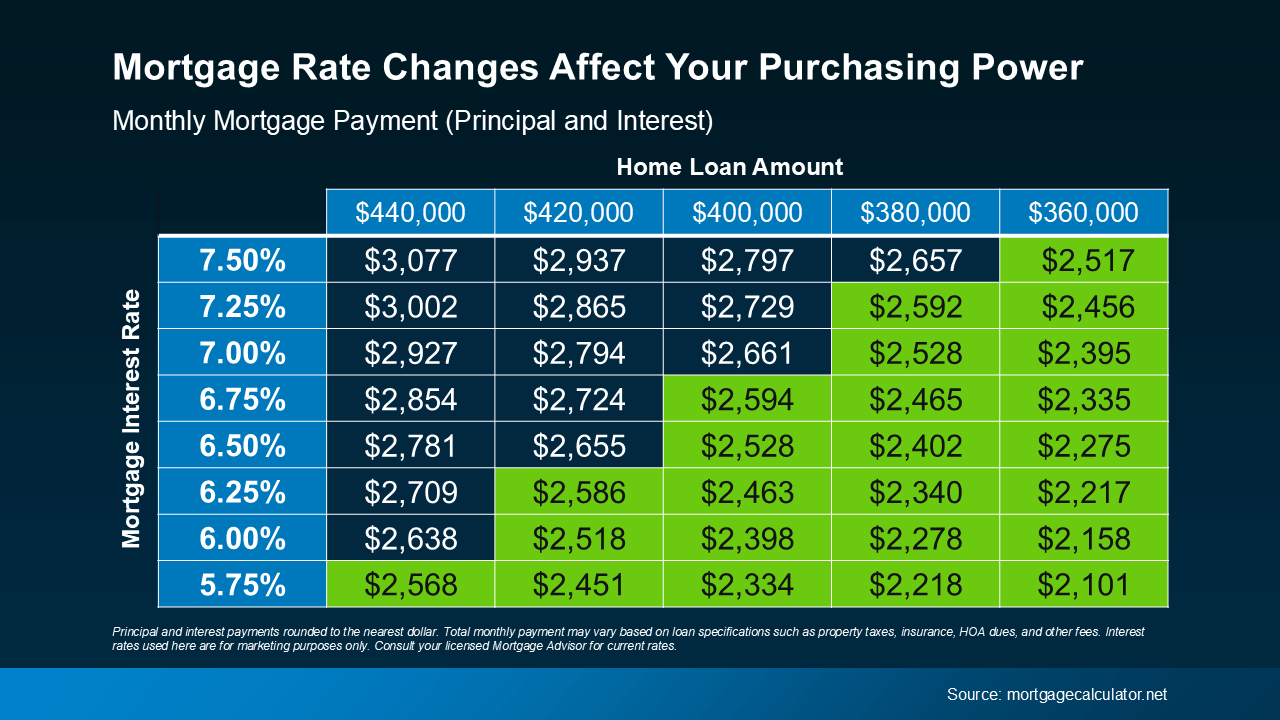

How Mortgage Rate Changes Affect You Even a slight change in mortgage rates can significantly impact your monthly home loan payment. Understanding this can help you make informed decisions about your home purchase. For instance, if you plan to budget for a monthly mortgage payment of $2,600, different mortgage rates will determine how much house you can afford within that budget. (Refer to the chart below for a detailed breakdown of how varying mortgage rates affect monthly payments).

Staying Updated on Mortgage Rates Keeping track of the latest mortgage rate trends is crucial when buying or selling a home. Real estate professionals, like those at Marks Realty Group, can provide expert insights and tools to help you navigate the complexities of the housing market. They can also offer visual aids, like the chart mentioned above, to illustrate how rate fluctuations can influence your purchasing power.

You don't need to be a mortgage expert to make the right decisions—you just need a trusted real estate agent by your side to guide you through the process.

Bottom Line If you have questions about the current housing market or need guidance on how mortgage rates impact your buying or selling plans, reach out to Marks Realty Group. We're here to help you understand the market and make the best decisions for your real estate journey.

Source: Keeping Current Matters