According to keepingcurrentmatters.com, there is a lot of discussion around the Federal Reserve's (the Fed) recent actions and their potential impact on the housing market and mortgage rates. For anyone considering buying or selling a home, understanding how the Fed's policies influence borrowing costs can help you anticipate future mortgage rate trends.

The Fed is meeting this week to discuss adjustments to the Federal Funds Rate, which is the rate banks charge each other for short-term loans. While this rate does not directly set mortgage rates, it can indirectly impact them. Here’s what you need to know about the Fed's approach and how it could affect housing.

Key Economic Indicators Influencing the Fed’s Decisions

The Fed's decisions are primarily guided by three economic indicators:

Inflation Trends

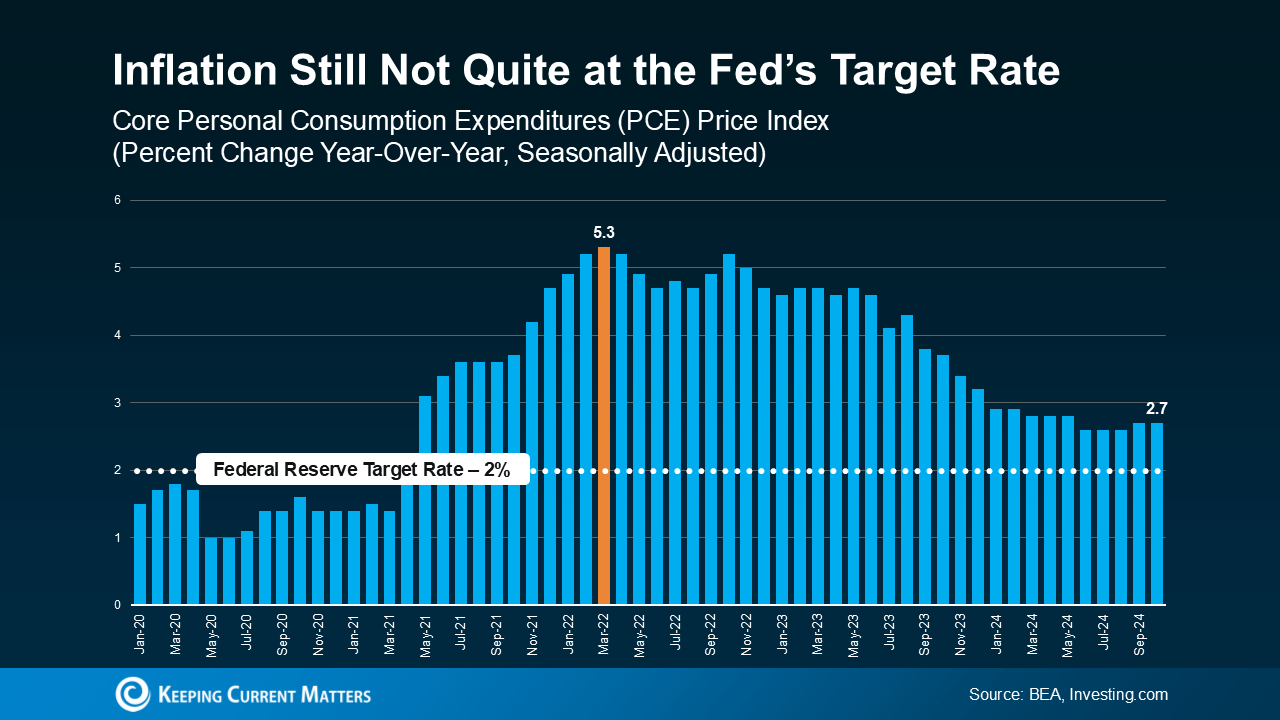

Inflation has led to higher prices on goods and services, and the Fed aims to reduce inflation closer to its target of 2%. Over the last two years, inflation has been slowly declining but is not yet at the desired level. Reducing the Federal Funds Rate could help control borrowing costs, which may eventually support lower mortgage rates.

Job Growth Rates

The Fed is closely monitoring job creation. A slower rate of job growth aligns with the Fed's goals, as it shows a cooling economy. Recently, U.S. employers have added fewer jobs, indicating a potential decrease in interest rates. According to , October saw the lowest job growth since 2020, supporting the Fed’s objectives.Unemployment Levels

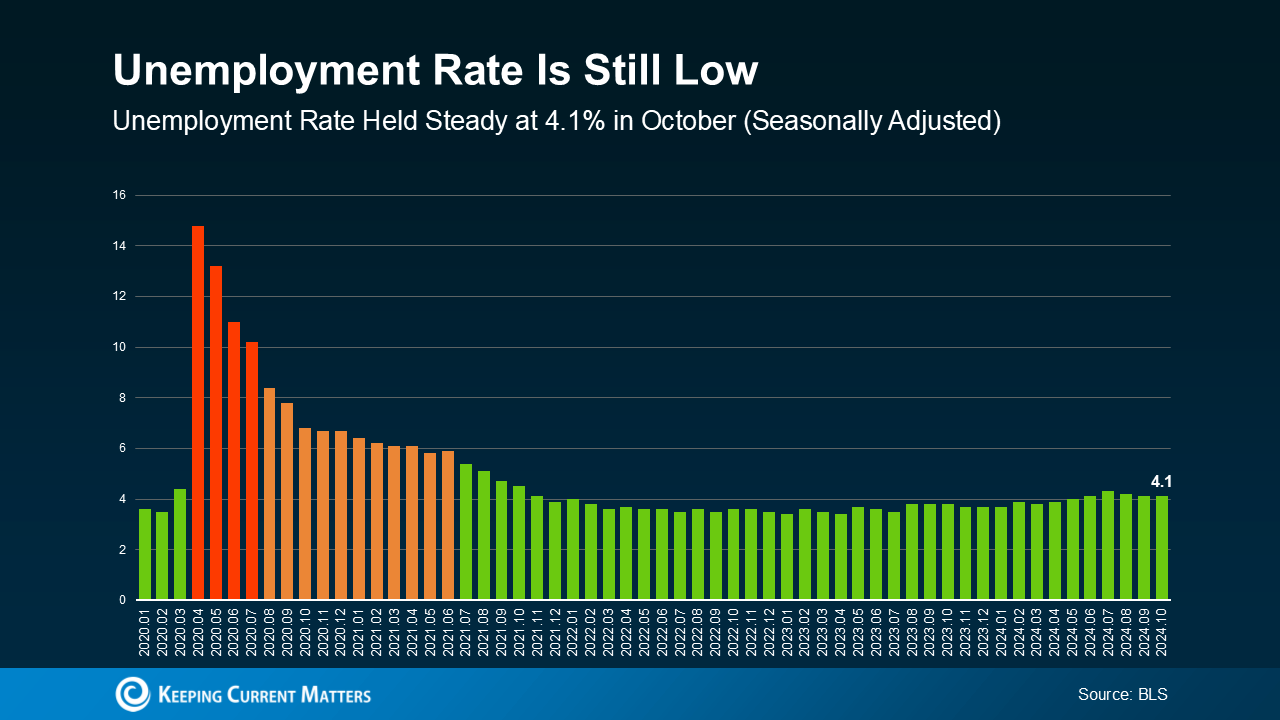

A low unemployment rate (currently around 4.1%) reflects a strong labor market, although it can also increase inflation. The Fed sees this balance as an indicator of economic stability, which may encourage them to lower the Federal Funds Rate.

What This Means for Future Mortgage Rates

As long as these economic indicators move in the desired direction, experts expect the Fed to reduce the Federal Funds Rate, potentially paving the way for mortgage rates to decrease. However, mortgage rates won’t drop immediately, as other market factors also influence them. According to Realtor.com economist Ralph McLaughlin, mortgage rate trends depend on labor market performance, inflation, and potential political shifts.

While Federal Reserve policies impact mortgage rates, economic data and market conditions remain the main drivers. As we progress through 2024 and into 2025, anticipate gradual stabilization or decreases in mortgage rates, bringing more certainty to what has been a volatile market.

Source: Keepingcurrentmatters.com